Choose a category based on the question you want to solve

- General

- Accounting

- Affiliates

- Regulation

- ESG

Please refer to the excel sheet called “Participation in subsidiaries” located in the Valuation Kit.

A single list that has been accepted by the main shareholders, submitted by the Ministry of Finance, has been submitted in ISA’s Shareholders’ Meetings. This list meets the minimum number of independent members set forth in the Corporate Bylaws. However, if shareholders wish to submit several lists, Decree 3923 of 2006 must be enforced. This Decree establishes the following: Article 1. Election of the boards of directors of issuers of securities. To elect the board members of issuers of securities, there should be two voting processes in the shareholders’ meeting or equivalent entity. One of the processes shall elect independent members according to the law or the bylaws, and the other process shall elect the rest of members. To this effect, independent member election lists shall only include people who meet the qualifications set forth in paragraph 2 or Article 44 of Law 964 of 2005, without prejudice to including people who meet such qualifications in lists to elect the rest of members. First Paragraph. According to Article 44 of Law 964 of 2005, bylaws of issuers of securities, including those who are entities monitored by the Financial Superintendence of Colombia, may provide for that there shall be no alternates in the boards of directors or equivalent entity. When the bylaws of the corresponding issuer of securities have not provided for the elimination of alternates in the board of directors or equivalent entity, alternates of the main members shall also be elected during the corresponding voting processes. Second Paragraph. During elections, the quotient system shall be implemented, which shall be calculated by dividing the total number of valid votes issued by the number of people to be elected in each of the voting processes. The foregoing without prejudice that bylaws of registered entities may implement a different voting system once the Colombian government has established and regulated voting systems other than the quoting system, which may be implemented by these entities pursuant to Article 39 of Law 964 of 2005. Third Paragraph. The election of all the members of the board of directors shall be held in a single voting process whenever it is ensured that the minimum number of independent members required by the law or the bylaws will be achieved, when the bylaws of the corresponding issuer have established that all the members of the board of directors shall be independent pursuant to criteria established in paragraph 2 of Article 44 of Law 964 of 2005, or when only one list including the minimum number of independent members required by the law or the bylaws has been submitted.

Please refer to “projects under construction” in the Valuation Kit.

Colombia | 35% for 2022 and for 2023 on |

Brazil | 34% |

Chile | In the semi-integrated system 27% (2018 onwards). |

Bolivia | 25% |

Peru | REP:27% ISA Perú: 22% CTM: 30% PDI: 29,5% |

View of the consolidated information, which includes eliminations of intercompany transactions (IFRS). Figures in COP million

2022 | Figures in million | Colombia | Chile | Brazil | Perú | Other | Total |

12M | Energy | 2.670.532 | 397.738 | 4.501.907 | 2.375.552 | 60.675 | 10.006.404 |

Roads | 357.135 | 2.510.364 | – | – | – | 2.867.499 | |

Telecom. | 219.791 | 30.834 | 68.520 | 139.645 | 24.813 | 483.603 | |

Total | 3.247.458 | 2.938.936 | 4.570.427 | 2.515.197 | 85.488 | 13.357.506 |

2021 | Figures in million | Colombia | Chile | Brazil | Perú | Other | Total |

| 12M | Energy | 2.243.209 | 321.923 | 3.878.894 | 2.104.422 | 112.048 | 8.660.496 |

Roads | 349.380 | 1.736.951 | – | – | – | 2.086.331 | |

Telecom. | 175.680 | 31.085 | 66.374 | 115.265 | 26.310 | 414.714 | |

Total | 2.768.269 | 2.089.959 | 3.945.268 | 2.219.687 | 138.358 | 11.161.541 |

2020 | Figures in million | Colombia | Brazil | Perú | Chile | Other | Total |

Energy | 2.007.696 | 292.129 | 3.696.297 | 2.026.448 | 108.972 | 8.131.542 | |

Roads | 95.672 | 1.561.599 | – | – | – | 1.657.271 | |

Telecom. | 158.652 | 31.213 | 64.170 | 90.481 | 34.497 | 379.013 | |

Total | 2.262.020 | 1.884.941 | 3.760.467 | 2.116.929 | 143.469 | 10.167.826 |

Please refer to “Energy Concessions Term” in the Valuation Kit.

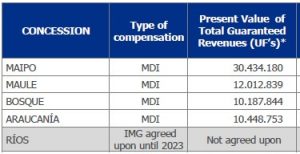

Roads

It corresponds to the dates according to the MDI (Mecanismo de Distribución de Ingresos) methodology; These dates are reviewed each year in accordance with the executed and projected toll revenue. The validity of the concessions is variable due to the payment methodology. The total income is guaranteed as a Present value in UFs. This means that each year the end date of a new concession is calculated.

For detailed information, please refer to “Roads Regulation” located in the valuation kit.

Please refer to the information located in the Valuation Kit.

So far, the regulator has issued three draft resolutions. The last one was issued in 2016, and established:

- Change from a scheme of Replacement Value at New (VRN) to one of Depreciated Replacement Costs (CRD),

- Revision of the different parameters that are part of the methodology for the determination of income.

- Parallel to the tariff revision, the CREG issued resolutions 004/21 and 073/21, which establish the methodology to estimate the cost of capital recognized for transmission, a key component of the tariff definition. However, the value has not yet been defined, since it will depend on the market parameters at the time the new scheme comes into operation. This was a very positive discussion in which ISA had an active voice and relevant adjustments were made to the definition.

- The expectation was that the WACC would be reduced by almost 300 bps, and if we applied the agreed methodology with the assumptions of the current market, the reduction would be a little more than 100 bps.

We hope that at the first half of 2023, we have a fourth draft resolution, whose application could begin as early as 2024, considering the different procedures and processes required so that said resolution can be given application to the different transmission companies, which its application will begin in 2025.

Revenues are regulated for assets under operation as of January 1st, 2000. They are regulated in accordance with the formula revised each five (5) years. These revenues correspond to 57% of the total revenues of the transmission business in Colombia (ISA + Transelca).

For assets under operation after January 1st, 2000 (approximately 7% by June 2008), revenues are equal to bidding number. After 25 years, this remuneration is subject to regulated methodology.

CREG Resolution 011 of 2009: The CREG established methodologies to determine the regulated revenues and the quality scheme of the transmission service in Colombia, for the new regulatory period. The CREG has approved special resolutions for all domestic transmission companies, thus, in the case of ISA, said resolution (078 of 2011) was in effect since August 1st, 2011. Under this resolution, ISA’s annual regulated revenues are reduced by 1% compared with the revenues it received under the methodology in effect since 2000.

In the last quarter of 2012, CREG issued Resolution 093, which complements the quality of service scheme established in CREG Resolution 011 of 2009, and sets higher demands for transmission companies in terms of availability of assets, this scheme became effective on April 1, 2013.

For further information, please refer to the valuation kit, in the excel sheet “Energy Regulation”.

Bolivia:

- The superintendence may decide whether a call option or a specific awarding is to be made

- The discount rate is 10%.

- The payment period is 30 years.

- The adjustments of tariffs depend 65% on the exchange rate and 35% on the CPI.

Peru:

- Projects in Peru are made by concession.

- The adjustments to tariffs are made at a rate of “Finished Goods less Food and Energy”.

- Revenues are fixed in US Dollars and paid in Peruvian Soles.

- The discount rate is 12% for most projects

Chile:

- Projects in Chile are awarded through international competitive bidding.

- They have exploitation rights in perpetuity.

- For the first 20 years the income is the offer that delivers the proponent. It is indexed with a formula that takes into account the CPI and Chilean exchange rate. From the year 21 on is remunerated to the value that says the regulation. It is indexed annually with the same formula.

- Revenue is set in U.S. Dollars but is paid in CLP.

- The discount rate is 10% real in dollars from the year 21.

Brasil:

There are 3 types of contracts (categories):

- Category 1: 73% of income. Concessions prior to 1998: (contract # 059)

- Income updated to the IPCA annually

- Rate Review every 5 years (O&M, WACC and regulatory asset base)

- Category 2: 1% of income. contracts from 1999 to 2006.

- Income updated to the IGPM annually

- 50% reduction in income in year 16

- There is no rate review

- Review of Reinforcements and Improvements from June 2019 and every 5 years.

- Category 3: 26% of income. Contracts after 2006.

- Income updated to the IPCA annually

- 30-year contracts with 3 rate reviews (Kd).

- Review of Reinforcements and Improvements every 5 years.